Environment

Short Takes

Georgia’s new data center rule increases local controlDecember 1, 2025

By David Pendered

March 21 – Private and institutional investors are planning a big surge of investments in new and existing affordable multifamily housing in states that could include Georgia, according to a report by the New York Fed.

“The majority of respondents indicate that they anticipate raising more equity in the next 12-24 months than they have since 2017 [in total over five years],” according to an analysis of a survey published in “A Case Study of Multifamily Affordable Housing Private Investment Vehicles” and a statement released March 6.

Furthermore, “Respondents also said they plan to more than quintuple their investment in new construction projects in the next 12 to 24 months.” This is a shift from historic investments in preservation of existing multifamily affordable housing structures, according to the statement.

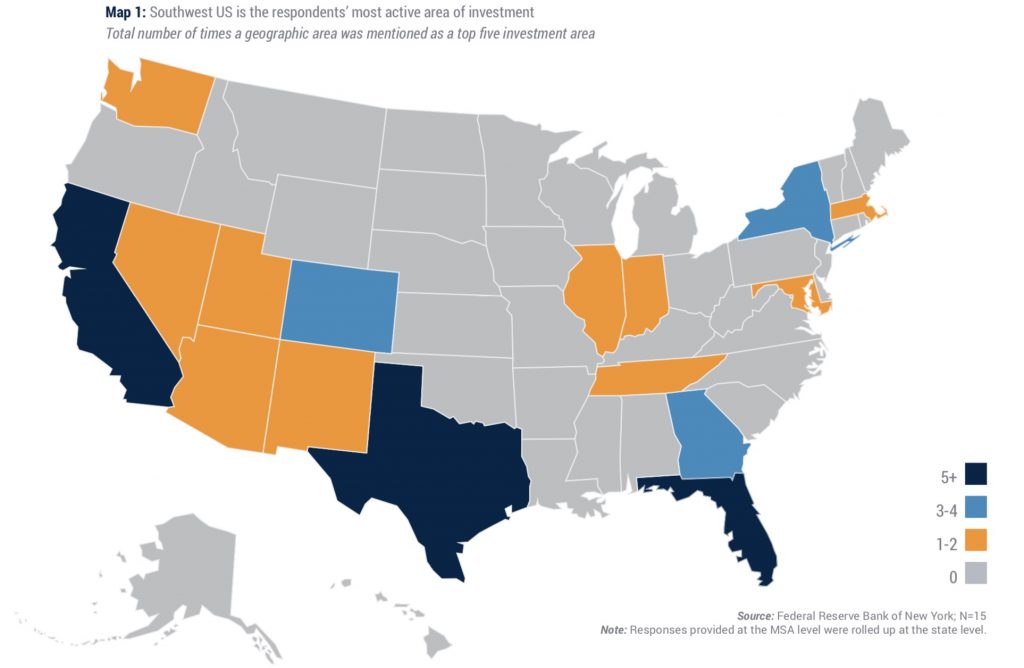

A map in the report shows 16 states where the survey respondents reported their most active investments. Georgia has three to four areas identified as a “top five investment area.” The states with five or more such areas are California, Florida and Texas.

If these investment plans come to fruition, the units will add to the growing proportion of housing in Georgia owned by major investment firms. Lawmakers in the current session of the General Assembly have joined local government officials in the debate over whether, and how, to construct a response to the growing portfolio of investor-owned dwellings and the build-to-rent market.

The Federal Reserve Bank of New York determined the investment companies plan to expand their business model regarding multifamily affordable housing. The companies have preferred to preserve existing affordable units and now plan to increase investments in new-build affordable housing. The proportion of respondents who intend to invest only in preservation fell from 62% to 31%.

This could affect the existing stock of affordable housing built with the nation’s premier program for affordable housing, the Low Income Housing Tax Credit. Credits expire after 15 years and can be extended if the owners resyndicate LIHTC. The reports notes “it is possible that the growth of private capital in the purchase and sale of properties at the end of their LIHTC compliance periods is emerging as a more frequent alternative to tax credit resyndication.”

The issue of investor-owned properties has roiled in Georgia as rising housing costs have spurred questions about who owns the housing. Georgia ranked first in the nation for the highest proportion of housing purchased by investors in 2021, according to this report published by Stateline, an initiative of The Pew Charitable Trusts.

For the latest report, the Federal Reserve Bank of New York surveyed an array of investors and found they plan raise major sums to buy existing units of affordable housing and build new ones. The dwellings are to be priced for tenants earning no more than the salaries of schoolteachers and clerks, and sometimes at greatly reduced prices.

These are big players, and they remained anonymous. Fifteen managers of nationally focused affordable multifamily investment vehicles responded to the survey. Each reported a median portfolio of 5,619 affordable housing units and fundraising of a median of $300 million since 2017. Of that, a median of $169 million was invested.

The investor mix includes “banks, pension and endowment funds, and high-net-worth individuals,” according to the report. These groups account for 74% of capital raised by the companies, according to their self-reports.

The report acknowledges the debate over the growth of investor-owned properties occurring nationwide and observed:

0